How to Active Amazon Pay Later, Benefits Of Amazon Pay Later, Amazon Pay Later Registration Full Process, Shopping with Amazon Pay Later, Active Amazon Pay Later in India

Application Link: https://play.google.com/

👉You can access Amazon Pay Later dashboard on your Amazon App.

👉 Open Amazon App,

👉 click on Amazon Pay to open Amazon Pay dashboard.

👉 Click on Amazon Pay Later to open Amazon Pay Later dashboard.

Amazon Pay has introduced a new credit service in India called Amazon Pay Later that offers merchandise repayment extending as long as 3-12 months. The eCommerce giant is also partnering with Indian Railways so it can get more essential goods to a larger population of people who need them.

There is zero interest if the money is repaid in the next month. Installment plans for up to 3-12 months are charged a nominal interest rate, according to a statement by Amazon India.

“Amazon Pay Later is a unique service that will help customers expand their access to credit and experience the most convenient option of making payments,” said Mahendra Nerurkar, CEO of Amazon Pay India.

The instant credit line enables users to pay their monthly utility bills as well as purchase necessities, groceries, electronics and clothing,Mobile,Daily essentials... etc

Amazon Pay teamed with Capital Float and The Karur Vysya Bank (KVB) to launch the Amazon Pay Later service. Based on usage and repayment, customers can increase their credit lines.

What is Amazon Pay Later?

Amazon Pay Later is the hassle-free way to get instant credit, via a completely digital process, for purchases using EMI on Amazon.in. You have to complete the one-time setup process, which should not take more than 2 minutes and does not require you to provide credit card details.

Once the setup is complete, you can avail Amazon Pay Later payment option during checkout on Amazon.in, and pay later next month or over EMIs ranging from 3 to 12 months. You can easily track your purchases, repayments, and limits history from a simplified dashboard for this payment mode. Amazon Pay Later is offered to you by Amazon Pay (India) Private Limited ("Amazon") and a third-party lending partner, Capital Float.

Is Amazon Pay Later same as Amazon Pay EMI?

Yes, both are same. Amazon Pay EMI has been re-branded to Amazon Pay Later.

What are the key benefits of Amazon Pay Later?

- Get instant decision on your credit limit by the lender.

- Credit card details not required.

- No processing or cancellation fee.

- No pre-closure charges.

- Seamless checkout on Amazon.in using Amazon Pay Later payment option.

- Simplified tracking of expenses and repayments on the EMI specific dashboard

Why am I not getting the option to register for Amazon Pay Later?

We have made Amazon Pay Later available for a limited set of customers. We are working towards enabling it for a larger set of customers. We appreciate your patience.

Amazon Pay Later Registration Process:

How can I register for Amazon Pay Later?

Go to Amazon Pay Later registration page on your Amazon.in mobile App and follow simple on-screen instructions.

Step 1: Chose your preferred KYC mode?

You will be shown 2 modes of KYC completion:

1. Existing KYC

(shown only in case you have completed KYC for Amazon Pay Balance).

2. OTP Based eKYC

If you opt for Option 1, i.e. Existing KYC, you will need to follow the below steps:

Step 1: Verify Identity

Enter missing 4 digits of the PAN Card you used for completing the KYC for Amazon Pay Balance.

Post submission of details, your profile will be evaluated, and Amazon Pay Later limit will be determined which will be displayed to you on the next screen.

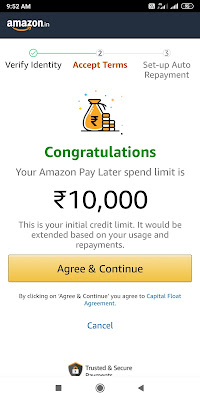

Step 2: Accept Terms

Your approved Amazon Pay Later limit will be displayed on this screen along with the loan agreement. Please read and accept the agreement to complete Amazon Pay Later registration. This sanctioned limit will become active within few minutes of completing the registration.

If you opt for Option 2, i.e. OTP based, you’ll need to follow the below steps:

- Verify Identity

- Enter your complete PAN card number and click Continue.

- Enter your complete Aadhaar number and click Continue.

- You will receive an OTP on your mobile number registered to your Aadhaar number. Enter the OTP and click continue.

Post submission of details, your profile will be evaluated, and Amazon Pay Later limit will be determined which will be displayed to you on the next screen.

Accept Terms

Your approved Amazon Pay Later limit will be displayed on this screen along with the loan agreement. Please read and accept the agreement to complete Amazon Pay Later registration. This sanctioned limit will become active within few minutes of completing the registration.

Amazon Pay Later Is PAN Card mandatory?

PAN number is mandatory for completing Know Your Customer (KYC) checks. If you don't have a PAN, you will not be able to complete the registration and hence not be able to avail Amazon Pay Later.

My internet got disconnected while registering. What should I do now?

In such cases, you can restart the Amazon Pay Later registration process from Amazon Pay Dashboard, on your Amazon.in mobile app/mobile browser once you have stable internet connectivity. You will start from the last step where you got dropped / disconnected.

Why was my Amazon Pay Later registration declined / rejected?

Following are the probable reasons for decline / rejection for the Amazon Pay Later registration:

- You did not accept the final loan agreement post generation of limit under Amazon Pay Later.

- You are currently not eligible to avail Amazon Pay Later as per the relevant and applicable terms and conditions and/or internal policies of our lending partner.

- Your KYC document verification failed

إرسال تعليق