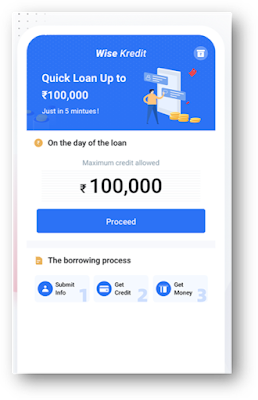

WiseKredit: Instant Personal Loan Rs.10,000 to 60,000 Without income proof or Salary Slip

Application Link: https://play.google.com/

WiseKredit is merely a facilitator providing the Platform for any person in need of financial products. WiseKredit provides various kind of personal loan products as specifically detailed under Clause 2 to its Users.

WiseKredit is merely facilitates a transaction between two such persons. WiseKredit is not an organization registered with the Reserve Bank of India and does not hold any license to engage in any activities relating to lending or borrowing. WiseKredit is not a Financial Institution under the Companies Act, 2013 or the Banking Regulation Act, 1949 or any other laws for the time being in force in India.

WiseKredit is also not a deposit taking company or a chit fund or a company offering any investment schemes as per the rules and regulations for the time being in force in India.

In the event You wish to avail any of the Products displayed on the Platform, You will be required to provide certain information and our representatives may contact You through phone or email to understand Your requirements.

WiseKredit provides various services, including but not limited

Wisecredit is a secure and reliable inclusive financial loan app. With user experience in mind, we constantly optimizes and improves functions to provide users with better, faster and reassuring loan services.

[Product Features]

Age requirement must be above 18+ years old

High loan amount:

apply online, up to rs.4000

Low-interest rates:

Annualized rates35.77%

Loan term:

91 days (shortest, including renewal period) - 120 days (longest, including renewal period)

Service Tax:

The service fee is 12% of the loan amount and the tax is 2.2%.of loan amount. The service tax will be deducted from the loan amount.

For example: If the loan amount is ₹8000 and the interest rate is 30% per annum with the tenure of 91 days, after deducting the processing fee, the interest payable is as follows :

Interest = ₹ 3000 * 35.77% / 365 * 91 = ₹ 267.54

Why wisecredit ?

1. High Credit lines: Up to 4, 000 rupees on demand;

2. Low interest rates: The daily interest rate is as low as 0.1%;

3. simple procedures: Online application without face-to-face signature;

4. Flexible repayment: You can choose different installment repayment methods according to the actual needs; one click repayment by mobile phone.

Loan Qualification:

1.Citizens of India;

2.Above 18 years old;

3.Stable job and a legitimate source of income.

How to borrow money?

1. Install the Wise credit app from Google play store;

2. Register with mobile phone number and complete identity authentication;

3. Fill in the loan application form with basic information, upload the address certificate and identity certificate. All these processes take only a few minutes;

4. Confirm and submit your loan application;

5. We will review your application in a few hours. Once approved, the loan will be deposited into your bank account in a few minutes.

6. Please pay off the loan before the due system repayment dates. If overdue, the penalty--1% of loan amount--will be charged every day.

Safety statement:

All data is stored and transmitted through secure HTTPS encryption. Without your consent, we will not share your personal information and data with any third party. The platform will ensure 100% security of your information.

Contact:

Customer service email:

india.cybertel@gmail.com

Customer service time: 7* 24 hours.

Address:

402 business avenue,

Above cosmos bank lane,

No.6 koregaon park ,

Pune, Maharashtra 411001

إرسال تعليق