Get Fast Rs.50,000/- Convenient, Low Interest Loans on LeCred Instant Personal Platform for Low Income 10,000/-,15,000/-,or 20,000/-

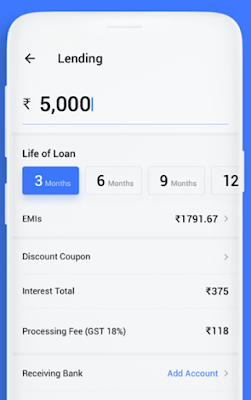

LeCred is an online consumer fintech platform for young adults in India. LeCred allow our customers to apply for instant personal loans which are fulfilled by our NBFC partners. Loan Amount ranges from ₹ 5,000 to 50,000. Tenure ranges from 91 days to 12 months. Interest rate starts at 2.5% per month.

LeCred launched LeCred, our online consumer finance platform in January 2020. On LeCred, we allow our customers to apply for instant personal loans which are fulfilled by our NBFC partners. All of our loan products are unsecure and feature fixed monthly payments with various terms. The application process is completely online, simple and convenient. Once the loan is approved, the cash is transferred to the bank account of the user instantly by our lenders.

1. Low Interest Rates

- Interest Rate From @ 20% p.a

- No hidden charges

- Loan upto ₹150,000

2. Fast

- Get money in 10 minutes

- Loan approval within 10 seconds

- Instant Disbursal

- 100% Online Process

- Easy Documentation

- Completely Safe & Secure

If the loan amount is ₹10,000 with the tenure of 6 months, after deducting the processing fee, the interest payable is as follows:

Interest = ₹ 10,000 x 30%/12 x 6=1,500

The interest rate and processing fee are various based on users' risk profile and loan product availed. The maximum interest rate is 36% per annum, and the processing fee starts at 2%.

Product Features:

All of LeCred loan products are unsecured and feature fixed monthly payments with various tenures.The application process is online, simple and convenient, and upon approval, the cash is transferred to the bank account of the user instantly by our NBFC partners.

Eligibility:

1. Indian Citizens

2. 18-45 years old

3. Pan Card / Student Card

4. KYC Address proof

5. Selfie

Lecred How it works:

1. Sign up using your Facebook account or Mobile Number

2. Take few minutes to fill in your basic details and upload your KYC Documents

3. After submitting the documents we check your eligibility with our NBFC partner

4. You will receive credit after NBFC’s approval

5. NBFC partner credits loan amount to your account instantly after eSign

How to apply?

1. Install LeCred App from Google Play.

2. Sign up using Facebook account or Mobile Number.

3. Take few minutes to fill in your basic details and upload your KYC Documents.

4. The application would be verified and approved by lending partner as quickly as possible and the results would be notified via SMS.

5. E-sign the loan agreement on approval from NBFC partner.

6. Once the eSign is successful, your loan will be disbursed within by NBFC partner and you shall be notified via SMS.

Additional information

LeCred Customer Service Email:

support@lecred.in

LeCred Customer Helpline Number:

1800121918888

LeCred Address:

#243, 2nd floor,

Aishwarya Ambassador,

3rd main road, 80 feet road,

Indiranagar,

Bengaluru 560038

1. What is LeCred?

LeCred is a fin-tech platform that facilitates personal loans of upto ₹ 50,000 to working professionals and college students. LeCred acts as a technology intermediary and facilitates personal loans from regulated lenders to individuals.The application process is completely online and can be availed 24*7*365.

2. Who can use LeCred?

Indian Citizens

18-45 years old

Has a monthly income

3. How does LeCred work?

Install LeCred app from Google Play/App Store.

Register with your mobile number .

Select the product you need to apply .

Fill in your basic details, upload your KYC documents and submit.

1. What are the documents I must submit?

Photo of Pan Card

Photo of one Address Proof

Your Selfie

2. What is KYC for LeCred?

KYC is an abbreviation for Know Your Customer. This shows the documents issued to you by the Government of India like Aadhar card, Pan Card, Voter's ID card, Driving License, Passport, and so forth. KYC is a mandatory procedure for any loan sanctioning entities.

3. Is my profile creation & verification a one-time process?

Yes, it is a one-time process

4. Is my data safe with LeCred?

Yes, your data is safe with us. It helps us to know you better and determine if we can offer you a loan. We will not disclose your data to anyone without your permission.

The application would be verified and approved by lending partner as quickly as possible and the results would be notified via SMS

E-sign the loan agreement on approval from NBFC partner.

Once the eSign is successful, your loan will be disbursed within 5 min by NBFC partner and you shall be notified via SMS.

EMI Queries about LeCred?

1. How will I receive the LeCred loan?

When you apply for a loan for the first time, we will ask you to provide your receiving bank account details and we will verify your bank account. After you sign the agreement, NBFC partner will credit the amount into your receiving bank account.

2. Why didn't I receive the LeCred loan?

Please make sure the account details provided are correct. The delay from NBFC partner to credit the amount to your bank account should not be more than 2 working days.

If you have not received the payment for more than 2 working days, please contact us at: 1800121918888

3. What is the amount of my LeCred Loan repayment?

Please find your due amount on the app under the repayment tab on the homepage and we will also notify you the repayment amount via SMS.

4. When do I need to LeCred loan repay?

You need to repay your loan amount / installment on or before the due date. You can find your due date on the app repayment homepage.

5. How can I repay my LeCred Loan?

6. What happens if I don't pay back on time?

We would charge a penalty fee of 2% per day, and we will also report the overdue repayment to the credit bureaus via your lender, blacklisting your name etc.

7. Can I repay in LeCred loan advance?

Yes, you can repay in advance at any point of time.

8. How can I confirm that I have repaid successfully LeCred Loan?

When you make the repayment, we will notify you by SMS. You can also log into the app to check the repayment records.

إرسال تعليق