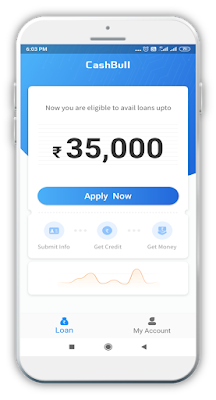

Cashbull is an instant personal loan app in India with an easy, fast and safe process

Application Link: https://play.google.com

CashBull is a mobile and web-based Non-Banking Financial Company (NBFC) in consumer finance lending and designed to make individual’s personal financing needs easier and faster. With simple, easy and fast services, CashBull offers easy, simple and fast loans for both self-employed and salaried persons ranging from 3000 Rupees to 10 Lakh Rupees.

CashBull understands your ever-changing needs of funds and long frustrating waiting times. With a completely online process, you don’t have to have to step out of your home and go all the way to a bank branch to furnish your documents to complete your application, and you can receive your loan amount upon approval directly in your bank account instantly! There is no guarantee or collateral required against the personal loan that you avail.

As a team of highly motivated individuals who are using new-age analytics and technology solutions, we are continuously striving to bring the most timely and pleasant credit experience to our customers.

Cashbull is an instant personal loan app in India with an easy, fast and safe process for those of you who are in need of instant personal loan for fast personal loan needs or salary advance loan needs.With a professional and experienced team, Cashbull will try to understand your instant personal loan needs, your fast personal loan needs and serve you wholeheartedly.We will try our best to help you to slove your instant personal loan online problem by providing you the fast personal loan app and instant personal loan service.

👉what Cashbull can provide?

💟 instantl personal loan: Get quick personal loan online with amounts up to Rs. 30,000.

💟 fast personal loan: apply online loan without any doucuments

💟 salary advance loan: Borrow money to cover smaller yet urgent cash loan needs.

💟 top up loan: provide instant personal loan apps in india and cover the your costs with our instant loans!

💟 cash Loan: Our cash loans can help you cover everything from monthly grocery bills to a child’s schools fees or even your outstanding bills that need to be cleared

💟quick loan: cashbull provides very fast and quick loan

💟earlysalary instant salary advance: We provide small personal loans, quick loans, salary advance loans and instant loans to both salaried and self-employed!

🏆 Features of CAshBull Loan:

👉 100% Online process

👉 Loan Amount: from 1000 Rupees to 6 Lakh Rupees.

👉 Loan Tenure: the shortest tenure is 91 days, the longest tenure is 365 days.

👉 Interest rate: Depends on the customer's risk profile and loan tenure. The maximum interest rate is 33% per annum.

👉 For example: If the loan amount is ₹10,000 and the interest rate is 30% per annum with the tenure of 91 days, after deducting the processing fee,

the interest payable is as follows : loan Interest = ₹ 10,000 * 30% / 365 * 91 = ₹ 748.

🔥Why CashBull?

⭐No bank credit card or CIBIL score required.

⭐Minimum Documentation and completely digital service

⭐Get 7*24 access to borrow money anytime and anywhere.

⭐Affordable and low loan interest rates.

⭐High loan approval rate.

⭐Quick Approvals & Disbursals.

📚Eligibility of CAshBull Loan:

✅ Indian Resident.

✅ 21-56 years old.

✅ Source of a monthly income.

💟Benefits & Risks

💓Get access to higher credit and tenures by repaying money on time

💓As compliance requirement your payment behaviour is shared with credit rating agencies; based on your payment behaviour your credit score may increase/decrease

📲How it works?

👍Install the CashBull loan app from the Play Store.

👍Register yourself via mobile number.

👍Fill in your basic details to check your eligibility.

👍After the submission, you may receive a call for verification. The final application result will be shown in the APP and you will be informed by SMS if approved.

👍E-sign the loan agreement after the approval

👍Get money (The loan is directly credited into your Bank Account ).

🔐Security:

Your data is safe with us. It is transferred over a secure HTTPS connection to us, and we do not share it with anyone without your consent except the lenders.

Contact Us:

Customer Service Email: help@cashbull.in ☝️

Address:

KUB Tower, Rd Number 3,

Sri Shyam Nagar,

Telecom Nagar,

Gachibowli,

Hyderabad,

Telangana 500032

1. What is CashBull?

CashBull is an Instant Personal Loan Platform for Young Professionals, where they can apply for a Short-Term Personal Loan up to ₹ 60000 as per their requirement. The application process is completely online, and on approval, the cash is immediately transferred to the bank account of the user.

2. How to apply for a loan from CashBull?

Please follow the below steps to apply a loan:

1.Install the CashBull App from Google Play Store & register an account with basic KYC details, then submit to us.

2.CashBull will verify and approve the loan.

3.After the approval, add your bank account & consent to our loan agreement on CashBull App, then approved loan amount will be disbursed into your account within 5 minutes.

3. On what criteria will the loan be sanctioned to me?

The loan approval is based on the information which you submit in CashBull. Also, your credit history play a major role in approval of any loan.

4. Am I eligible to get a personal loan from CashBull?

All Indian residents, aged between 21 to 56 years old, salaried or self - employed, having a monthly source of income, are eligible for a personal loan with CashBull. However, valid PAN and address proof are mandatory.

5. What is the minimum and maximum Loan Amount I can avail?

An Indian resident can avail loans from Rs.1000/- to Rs.60000/- per request. The final amount will depend on your available credit limit which is based on your profile.

6. When will I get the CashBull Loan?

Once you fill your personal information along with KYC documents and bank account. CashBull will verify the details and update you through SMS & Push Notification for approval. After that you need to give consent to CashBull loan agreement and CashBull will directly transfer the money into your bank account.

7. Which Platform does CashBull Support?

Currently CashBull App is only available for Android Mobile users.

8. Why I am getting "Pan Number Occupied" error message?

If the PAN number is already associated with another CashBull account, it shows an error "PAN Number Occupied". Try to login with your previous mobile number to continue to apply a loan or you can contact us if you think that a fraudulent activity is done using your PAN details.

9. Why the IFSC Code entered by me is showing as Invalid?

It happens when a customer update an IFSC Code which doesn't belong to any branch of a bank. Enter correct IFSC code or use another bank account.

10. Why the PAN number entered by me is showing as Invalid?

It happens when customer submits an incorrect PAN Number. Try to enter a correct PAN number.

11. Can I cancel CashBull Loan after applying?

No. After the CashBull loan application is submitted, it can't be cancelled.

12. Is my information secure with CashBull?

Don't worry! Your data is safe with us. All the transactions on CashBull are secured via 256-bit SSL encryption and the data is transferred over secured connections.

13. How to contact CashBull?

Please contact us via email: help@cashbull.in

14. Why my loan disbursement is pending?

Sometimes, bank faces the technical issue and takes upto 1 working day for the money to be processed into your bank account. Please write us on help@cashbull.in with your registered Mobile number after 1

15. My loan status is showing "Waiting for repayment" but I haven't received the money in Bank Account?

Usually the money reflects as soon as we disburse the amount. Please share the screenshot of your registered Bank Statement from the date when your loan gets approved along with your registered Mobile Number on help@cashbull.in

16. What should I do if my loan is disbursed to a wrong bank account which I entered by mistake.

While updating the bank details, you verified that you are primary account holder of your updated bank account. CashBull is not liable if the amount got disbursed in the said bank.

17. How can I increase my CashBull credit limit?

There is a good chance to increase this limit by availing more loans and making timely repayments. However, this also depends on other factors like your monthly salary, credit score etc.

18. Why my CashBull loan amount is not increasing even I am paying the loan amount on time?

Your credit records will gradually accumulate according to your repayments & credit data and the loan amount will increase accordingly.

19. What happens if I don't pay back on time?

CashBull will charge a 1% penalty fee per day.Your Credit score will be updated as a defaulter with credit rating agencies which will make it difficult for you to take loans with any bank or financial institution in the future. Companies also check an individual’s credit score and may not offer you employment if your credit score is bad.

20. Why my loan application is rejected?

There could be many reasons like poor credit score, iincorrect KYC documents, information mismatch. It is not always or necessarily a reflection of your credit worthiness. CashBull advice our customer to re-apply for a loan in 7 days in such cases.

21. I’m unable to pay on the CashBullApp. Is there any other way I can repay the loan?

No. Due to security purpose, we advice our customers to repay only through the CashBull App. If you are facing an issue while repaying your loan, contact us at help@cashbull.in. Important Notice: We never provide any Private Account by call or SMS to customer. Please do not repay to any private account not showed in CashBull App

Application Link: https://play.google.com

CashBull is a mobile and web-based Non-Banking Financial Company (NBFC) in consumer finance lending and designed to make individual’s personal financing needs easier and faster. With simple, easy and fast services, CashBull offers easy, simple and fast loans for both self-employed and salaried persons ranging from 3000 Rupees to 10 Lakh Rupees.

CashBull understands your ever-changing needs of funds and long frustrating waiting times. With a completely online process, you don’t have to have to step out of your home and go all the way to a bank branch to furnish your documents to complete your application, and you can receive your loan amount upon approval directly in your bank account instantly! There is no guarantee or collateral required against the personal loan that you avail.

As a team of highly motivated individuals who are using new-age analytics and technology solutions, we are continuously striving to bring the most timely and pleasant credit experience to our customers.

👉what Cashbull can provide?

💟 instantl personal loan: Get quick personal loan online with amounts up to Rs. 30,000.

💟 fast personal loan: apply online loan without any doucuments

💟 salary advance loan: Borrow money to cover smaller yet urgent cash loan needs.

💟 top up loan: provide instant personal loan apps in india and cover the your costs with our instant loans!

💟 cash Loan: Our cash loans can help you cover everything from monthly grocery bills to a child’s schools fees or even your outstanding bills that need to be cleared

💟quick loan: cashbull provides very fast and quick loan

💟earlysalary instant salary advance: We provide small personal loans, quick loans, salary advance loans and instant loans to both salaried and self-employed!

🏆 Features of CAshBull Loan:

👉 100% Online process

👉 Loan Amount: from 1000 Rupees to 6 Lakh Rupees.

👉 Loan Tenure: the shortest tenure is 91 days, the longest tenure is 365 days.

👉 Interest rate: Depends on the customer's risk profile and loan tenure. The maximum interest rate is 33% per annum.

👉 For example: If the loan amount is ₹10,000 and the interest rate is 30% per annum with the tenure of 91 days, after deducting the processing fee,

the interest payable is as follows : loan Interest = ₹ 10,000 * 30% / 365 * 91 = ₹ 748.

🔥Why CashBull?

⭐No bank credit card or CIBIL score required.

⭐Minimum Documentation and completely digital service

⭐Get 7*24 access to borrow money anytime and anywhere.

⭐Affordable and low loan interest rates.

⭐High loan approval rate.

⭐Quick Approvals & Disbursals.

📚Eligibility of CAshBull Loan:

✅ Indian Resident.

✅ 21-56 years old.

✅ Source of a monthly income.

💟Benefits & Risks

💓Get access to higher credit and tenures by repaying money on time

💓As compliance requirement your payment behaviour is shared with credit rating agencies; based on your payment behaviour your credit score may increase/decrease

📲How it works?

👍Install the CashBull loan app from the Play Store.

👍Register yourself via mobile number.

👍Fill in your basic details to check your eligibility.

👍After the submission, you may receive a call for verification. The final application result will be shown in the APP and you will be informed by SMS if approved.

👍E-sign the loan agreement after the approval

👍Get money (The loan is directly credited into your Bank Account ).

🔐Security:

Your data is safe with us. It is transferred over a secure HTTPS connection to us, and we do not share it with anyone without your consent except the lenders.

Contact Us:

Customer Service Email: help@cashbull.in ☝️

Address:

KUB Tower, Rd Number 3,

Sri Shyam Nagar,

Telecom Nagar,

Gachibowli,

Hyderabad,

Telangana 500032

1. What is CashBull?

CashBull is an Instant Personal Loan Platform for Young Professionals, where they can apply for a Short-Term Personal Loan up to ₹ 60000 as per their requirement. The application process is completely online, and on approval, the cash is immediately transferred to the bank account of the user.

2. How to apply for a loan from CashBull?

Please follow the below steps to apply a loan:

1.Install the CashBull App from Google Play Store & register an account with basic KYC details, then submit to us.

2.CashBull will verify and approve the loan.

3.After the approval, add your bank account & consent to our loan agreement on CashBull App, then approved loan amount will be disbursed into your account within 5 minutes.

3. On what criteria will the loan be sanctioned to me?

The loan approval is based on the information which you submit in CashBull. Also, your credit history play a major role in approval of any loan.

4. Am I eligible to get a personal loan from CashBull?

All Indian residents, aged between 21 to 56 years old, salaried or self - employed, having a monthly source of income, are eligible for a personal loan with CashBull. However, valid PAN and address proof are mandatory.

5. What is the minimum and maximum Loan Amount I can avail?

An Indian resident can avail loans from Rs.1000/- to Rs.60000/- per request. The final amount will depend on your available credit limit which is based on your profile.

6. When will I get the CashBull Loan?

Once you fill your personal information along with KYC documents and bank account. CashBull will verify the details and update you through SMS & Push Notification for approval. After that you need to give consent to CashBull loan agreement and CashBull will directly transfer the money into your bank account.

7. Which Platform does CashBull Support?

Currently CashBull App is only available for Android Mobile users.

8. Why I am getting "Pan Number Occupied" error message?

If the PAN number is already associated with another CashBull account, it shows an error "PAN Number Occupied". Try to login with your previous mobile number to continue to apply a loan or you can contact us if you think that a fraudulent activity is done using your PAN details.

9. Why the IFSC Code entered by me is showing as Invalid?

It happens when a customer update an IFSC Code which doesn't belong to any branch of a bank. Enter correct IFSC code or use another bank account.

10. Why the PAN number entered by me is showing as Invalid?

It happens when customer submits an incorrect PAN Number. Try to enter a correct PAN number.

11. Can I cancel CashBull Loan after applying?

No. After the CashBull loan application is submitted, it can't be cancelled.

12. Is my information secure with CashBull?

Don't worry! Your data is safe with us. All the transactions on CashBull are secured via 256-bit SSL encryption and the data is transferred over secured connections.

13. How to contact CashBull?

Please contact us via email: help@cashbull.in

14. Why my loan disbursement is pending?

Sometimes, bank faces the technical issue and takes upto 1 working day for the money to be processed into your bank account. Please write us on help@cashbull.in with your registered Mobile number after 1

15. My loan status is showing "Waiting for repayment" but I haven't received the money in Bank Account?

Usually the money reflects as soon as we disburse the amount. Please share the screenshot of your registered Bank Statement from the date when your loan gets approved along with your registered Mobile Number on help@cashbull.in

16. What should I do if my loan is disbursed to a wrong bank account which I entered by mistake.

While updating the bank details, you verified that you are primary account holder of your updated bank account. CashBull is not liable if the amount got disbursed in the said bank.

17. How can I increase my CashBull credit limit?

There is a good chance to increase this limit by availing more loans and making timely repayments. However, this also depends on other factors like your monthly salary, credit score etc.

18. Why my CashBull loan amount is not increasing even I am paying the loan amount on time?

Your credit records will gradually accumulate according to your repayments & credit data and the loan amount will increase accordingly.

19. What happens if I don't pay back on time?

CashBull will charge a 1% penalty fee per day.Your Credit score will be updated as a defaulter with credit rating agencies which will make it difficult for you to take loans with any bank or financial institution in the future. Companies also check an individual’s credit score and may not offer you employment if your credit score is bad.

20. Why my loan application is rejected?

There could be many reasons like poor credit score, iincorrect KYC documents, information mismatch. It is not always or necessarily a reflection of your credit worthiness. CashBull advice our customer to re-apply for a loan in 7 days in such cases.

21. I’m unable to pay on the CashBullApp. Is there any other way I can repay the loan?

No. Due to security purpose, we advice our customers to repay only through the CashBull App. If you are facing an issue while repaying your loan, contact us at help@cashbull.in. Important Notice: We never provide any Private Account by call or SMS to customer. Please do not repay to any private account not showed in CashBull App

إرسال تعليق