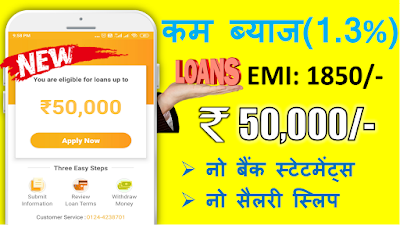

Apply Instant Personal Loan from Rs.2,000 to Rs.50,000 Without any income proof or No Paperwork/Easy Loan application Process

Application Link: https://play.google.com/

Cashtm is an instant personal loan platform for mobile users, especially for young white-collar workers across India. Cashtm offers loans up to Rs 50,000 with low interest rate in a convenient and secure way 24*7 online. The application processes can be completed at anytime and anywhere in 5 minutes. Once approved, the loan amount will be immediately transferred to the provided bank account.

Loan Amount:

from 2,000 to 50,000

Tenure:

Cashtm provides several instant personal loan products. The shortest product tenure is 61 days. The longest is 180 days.

Interest rate:

Depends on customer’s risk profile and loan product. The maximum interest rate is 36% per annum.

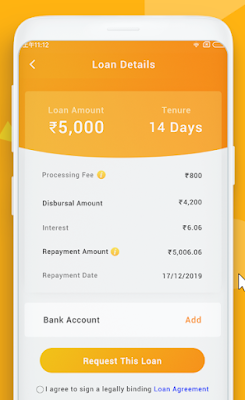

Processing fee:

Varies depend on effort to underwrite customer base on their credit

Example: For a 3 month 10,000 Rs loan, processing fee + gst is 400 Rs, interest is 470 Rs, monthly EMI is 3490 Rs, total replayment is 10470 Rs.

CashTM Loan App Features:

- 100% Online Process

- Higher Loan Amount

- Convenient Application and Fast Approval

- Low Interest Rate

- Data Security

CAshTM Loan App Eligibility:

- Indian Resident

- Age between 18 and 65

- Source of monthly income

- Aadhaar photos, PAN photos and Selfies

- Basic Personal information and Contact

- Address information

- Proof of work and Source of monthly income

How to get started:

- Install the Cashtm App from Google Play store.

- Register an account with your local phone number.

- Fill out your personal information.

- Upload Aadhaar, PAN card photos and selfies.

- Fill out your address, work and contact information.

- Select your product and wait approval result.

- Check disbursed loan amount at your bank account.

Post a Comment