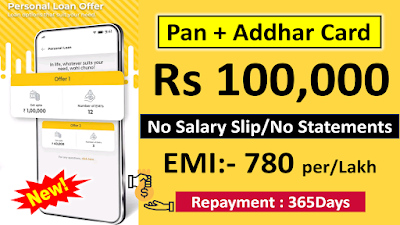

Instant Personal Loan ₹1000,000-Without Income proof/Aadhar card Loan Online/New Realme Paysa Application

Application Link: https://play.google.com/

Realme PaySa is a platform to provide hassle free digital financial services to our customers through the App. The platform currently provides 4 products personal and business loans, free credit report, mobile screen protection insurance (only for realme phones) and other services. You will be able to apply for loans, receive the funds and repay the funds all through the APP. We strongly value your data privacy and security and thus have taken many measures to provide you a safe experience.

1. Personal Loans:

Realme PaySa offer instant personal loan to a user above 18 years and Realme PaySa application process is simple, with minimal information requirements and money gets credited within minutes – All on your mobile phone. Realme PaySa notify you of your approval status instantly and further repayment through easy & flexible EMI options assures you of flexibility and security. We require minimum information and some very basic documents to process your loans. Our loans are offered in partnership with Early Salary.

Realme PaySa Key features:

- Loan range from INR 8000 to 10 lakhs including instant loan up to 1 lakh

- Money credited to bank account within minutes

- Interest rates between 24% to 30% annual basis, translating to 2% - 2.5% on a monthly basis

- Pay interest only on amount you utilize

- Flexible repayment tenure from 3 to 60 months

- Easy and quick approval process

Realme PaySa Calculation Logic:

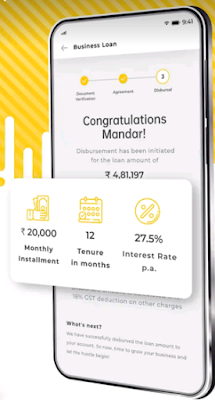

Eligibility of the customer is 50000, and user avails only INR 20,000. In this scenario customer loan amount will be INR 20,000 at an interest rate of 30% p.a. calculated on reducing balance with a processing fees of INR 399 + GST and repayable in 6 EMIs. This user will have a total interest outflow of INR 1,786/- per month EMI would be Rs 3,631/-

Our Criteria for approving the loan

- An Indian citizen

- Salaried individual

- Above the age of 18

- Minimum take home salary per month

>> ₹ 18k - Bangalore, Chennai, Delhi NCR, Hyderabad & Secunderabad,

Kolkata, Mumbai, Pune

>> ₹ 15k - Other cities

Realme PaySa Required Documents ?

5 documents to avail an instant personal loan online:

1. Selfie

2. PAN card

3. Address ID proof

4. Aadhar card

5. Bank statement

Realme PaySa How to get Loan:

1. Install our realme Paysa App

2. Register through your phone number / Email ID or Social Login (Google, Facebook or LinkedIn)

3. Click on Loan section and select salaried for personal loan

4. Fill in your basic details, along with your desired loan amount & repayment tenure with monthly net income to check first level eligibility

5. Upload your KYC documents – selfie, ID, Address Proof & PAN card.

6. Select the product and input max loan required

7. Get the loan disbursed as bank transfer within few minutes, subject to meeting our loan criteria

Where you can use this fund?

You may use the loan funds for any personal requirement like shopping, travel, education, medical expenses etc.

2. Free Credit Report

You can avail 3 Free Credit Reports with detailed analysis on your credit history, repayment status and analysis of your financial health. All you need to provide is few basic details and get going! You can use the tips to improve your credit score, which will be handy whenever you need a loan in future.

3. Mobile Screen Insurance

Get instant enrollment and avail upto 2 claims per year to protect your realme mobile screen insurance. The product is applicable to both old and new phones without going anywhere.

What we ensure?

Realme PaySa ensure your “Security & Protection to your Privacy”

Data security & privacy is our top priority. Our backend APIs comply with mandated security standards and robust protocols. We store data only based on your permission.

Realme PaySa want to hear you, please reach out to us for any customer service issue or problems

Customer Service Email:

wecare@realmepaysa.com

Our call center:

022-62661966

Registered Address:

Embassy 247, Unit no.901,

9th Floor, B-Wing, Hindustan Bus Stop,

LBS Road, Vikhroli West,

Mumbai, MH 400 083

Post a Comment